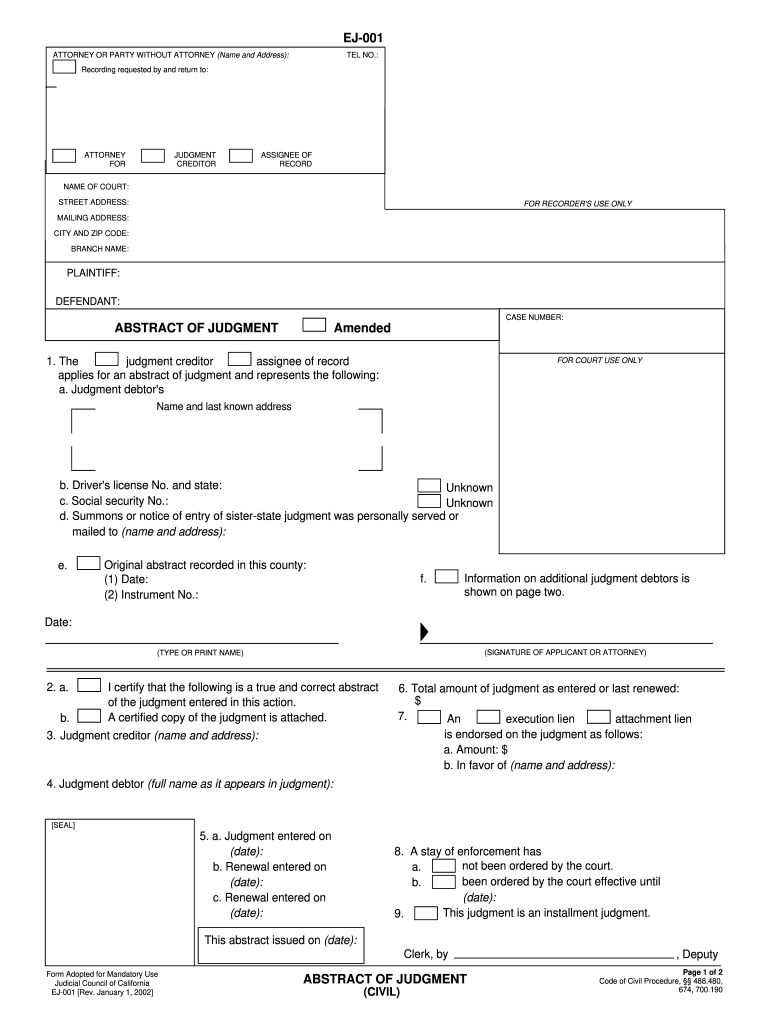

Abstract Of Judgement Lien Texas

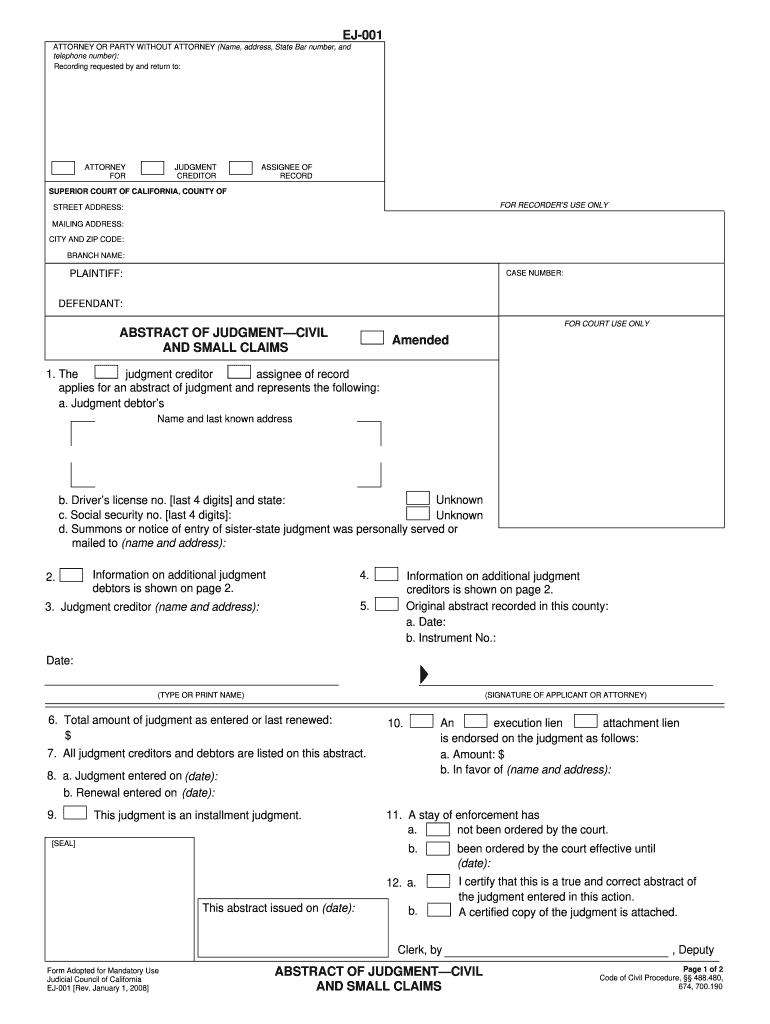

When properly recorded and indexed in the county clerks real property records an abstract of judgment creates a judgment lien on non exempt real property that is superior to the rights of subsequent purchasers and lienholders.

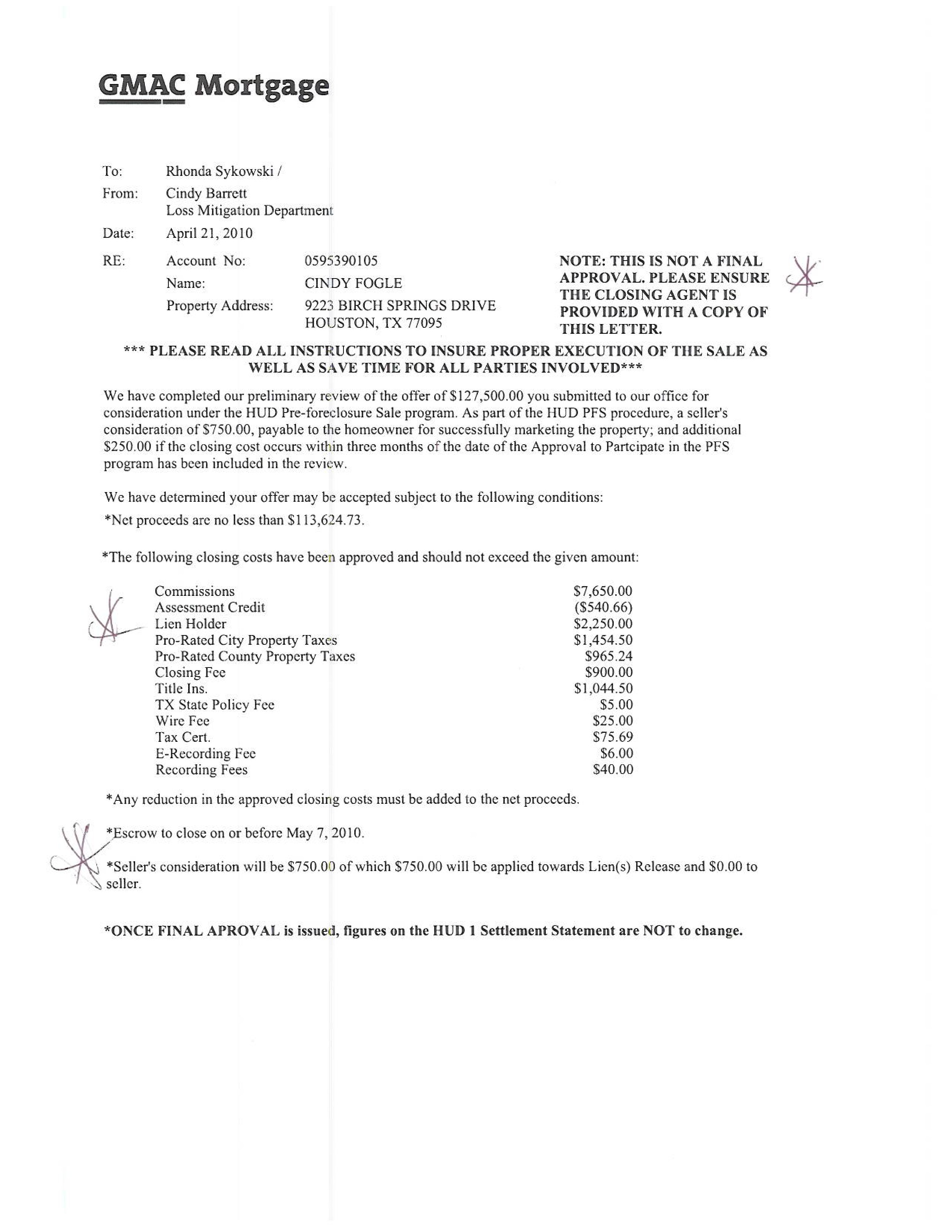

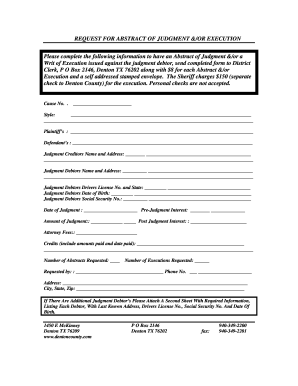

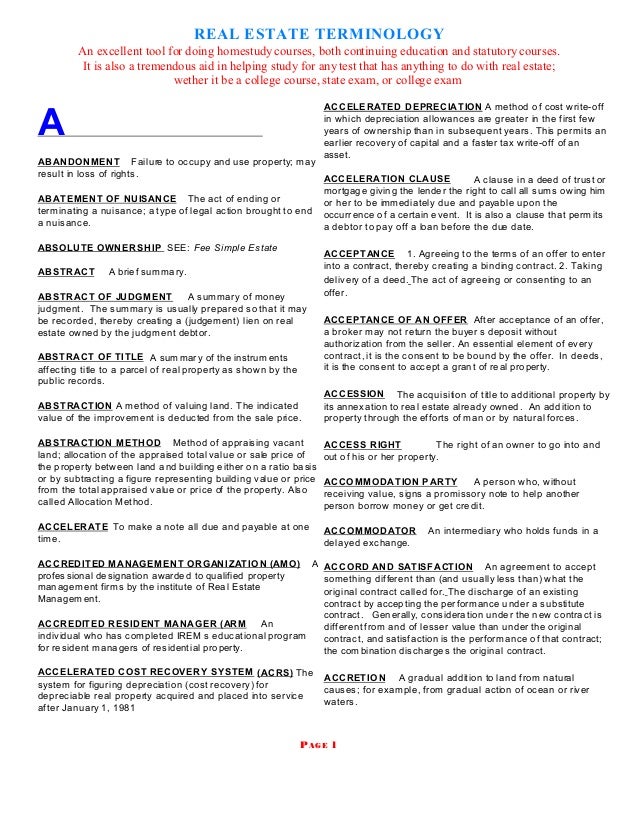

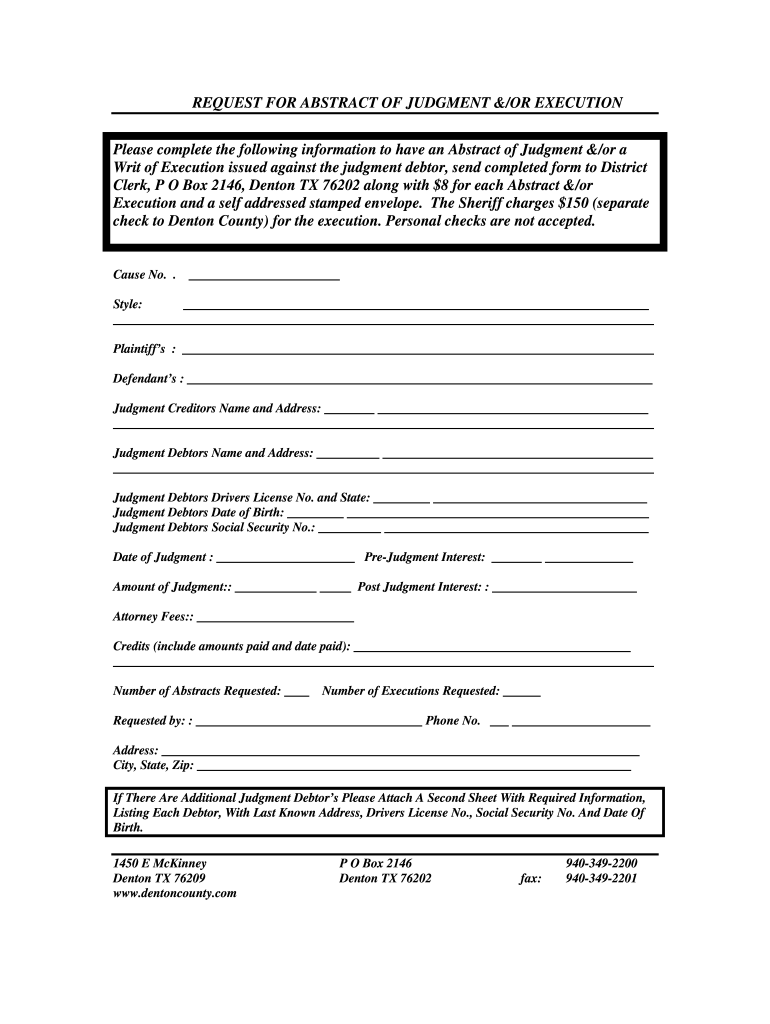

Abstract of judgement lien texas. Except as provided by section 520011 or 520012 a first or subsequent abstract of judgment when it is recorded and indexed in accordance with this chapter if the judgment is not then dormant constitutes a lien on and attaches to any real property of the defendant other than real property exempt from seizure or forced sale under chapter 41 the texas constitution or any other law that is located in the county in which the abstract is recorded and indexed including real property. These liens may be placed on real estate holdings vehicles and items of personal property to prevent their sale or disposal before the amounts owed have been paid. A texas abstract of judgment is always filed immediately after obtaining the judgment. The abstract creates a lien on the judgement debtors nonexempt real property in the county where the abstract has been recorded pursuant to texas property code 52001.

This means the judgment creditor cant take the house or force a sale. The lien continues for ten years from the date of recording and indexing as long as the judgment does not become dormant and the judgment may be renewed. Read on to understand the rules. So will file an abstract in every county that we think there may be property to be had in the future.

A texas judgment when properly abstracted in the real property records constitutes a lien on and attaches to any real property of the defendant other than real property exempt from seizure or forced sale under chapter 41 the texas constitution or any other law that is located in the county in which the abstract is recorded and indexed including real property acquired after such recording and indexing texas property code sec. The lien gives the creditor legal interest in the property and typically prevents owner from selling the property or getting a mortgage. A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtors property. So how do judgment liens work in texas.

In the state of texas judgment liens are a legal method for enforcing decisions made in court. A judgment lien is one way to ensure that the person who won the judgment the creditor gets what he or she is owed. A judgment is good for 10 years and can be renewed when it is nine years and six months old. The lien continues for ten 10 years from the date of recording and indexing with the county except in cases where the judgment becomes dormant during that period.

A lien against a homestead is not permitted in texas. The abstract is filed in the county where the defendant lives or where we know they own property. The abstract creates a lien against the debtors nonexempt real property in the county in which the abstract is recorded pursuant to tex.